‘To strengthen the lira, the central bank would likely need to drive Turkey into a recession and raise the overnight rate above the rate of inflation… After this inflation trade unwinds, and Turkey likely goes into a deep recession, asset prices will be very cheap which will offer the opportunity to buy high-quality and high-growth businesses at a cheap valuation.’

Almost three months back I had written an article on the iShares MSCI Turkey ETF (NASDAQ:TUR). This was prior to the presidential election. Now that the election has happened and we have seen the trajectory of where monetary policy is headed I want to revisit the thesis and see where things are headed from here.

The most surprising event that has happened is what I’m coining the Erdoğan Pivot.

Let me back up a bit to provide background on this. During the presidential election, there were two front runners. The first was the incumbent Erdoğan who has historically kept interest rates very low and let inflation run hot; in many ways, he can even be considered an MMT practitioner due to his staunch lowering of interest rates even as inflation rose. The challenger, Kemal Kilicdaroglu was seen as a hawk who would raise rates well above the rate of inflation, which would crush the economy.

When Erdoğan won there was a sigh of relief from the stock market and the lira fell because the risk of significant rate increases went away. But instead, with Erdoğan’s support the central bank pivoted and raised rates to fight the growing inflation.

This came as a shock to many as time and time again the central bank had said that rates weren’t going to go higher. I do believe there’s political calculus behind this rate hike. Prior to the election Erdoğan likely didn’t want to raise rates and cause the economy to go into a downturn, but now that he has won reelection he won’t have to worry about the next election for another few years, so it’s best for him to raise rates, even if it causes a recession, to avoid the even bigger issue of hyperinflation a few years down the line when the next election cycle comes around.

Another reason for this pivot is that the treasury has no choice but to make the lira stronger as they are quickly running out of foreign exchange reserves and the only way to get more would be to issue more debt, which would likely make the inflation and devaluation issue worse.

One of the issues that the Turkish government has created for itself is that it must continue to raise rates and strengthen the lira against the dollar due to its anti-dollarization policies. I discussed this in a previous article about two years back but will provide a brief synopsis here.

Turkey has an anti-dollarization strategy where bank depositors who hold liras will get compensated if there is a negative absolute return against the US Dollar. For example, if the interest rate one is getting paid on their lira is 15%, but the lira drops 20% against the US Dollar, then the Turkish government will pay the depositor the 5% difference.

This policy was implemented because the lira was quickly losing ground against hard currencies as Turks quickly sold their lira into more stable currencies.

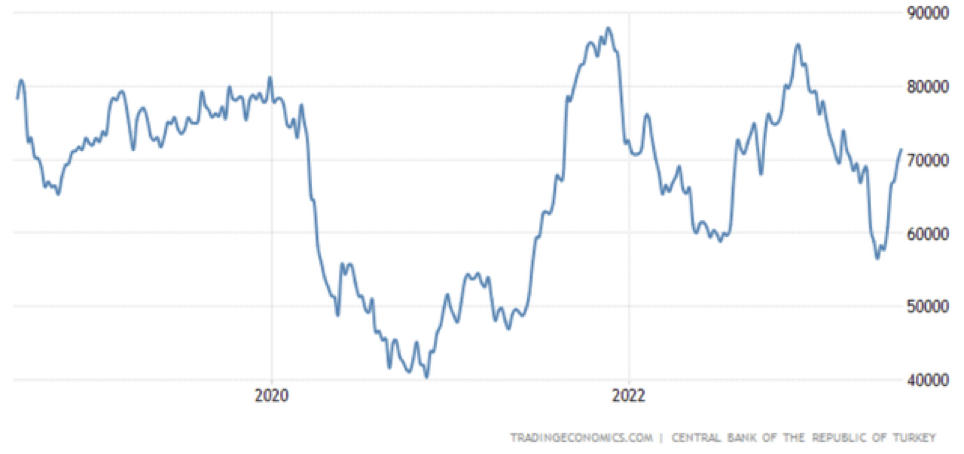

Below is a chart which shows the USD/TRY cross:

As can be seen above, the lira was quickly losing ground against the US Dollar in a parabolic manner. Because of this, the Turkish government had to find a quick solution to the issue of locals converting their lira into other currencies. The anti-dollarization strategy was the solution, and this caused the lira to double in value against the US Dollar, as can be seen where I’ve circled the chart.

The very obvious issue with this strategy is that the lira continued to weaken against the US Dollar.

As the lira continued to weaken the treasury would have to make large payments to depositors, which was quickly draining their foreign currency reserves.

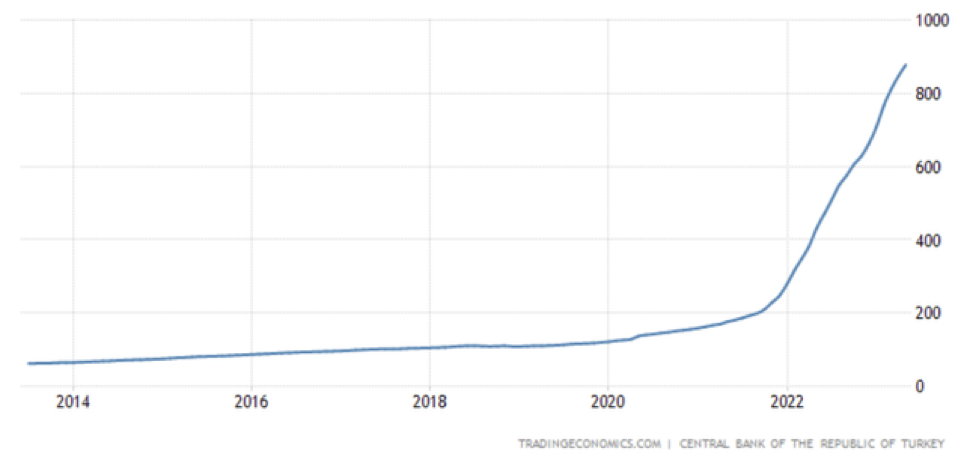

Below is a zoomed-out, updated chart of the USD/TRY cross:

While the treasury hasn’t explicitly said they were doing a dirty peg on the FX market, looking at the chart above does make it seem likely they were. The area that is circled has little volatility and it seems probable that the treasury was using its reserves to buy liras at that point which made for the artificially low volatility environment where the lira traded against the US Dollar in a very tight range.

Then it seems that after the May election, the dirty peg was removed and the lira weakened as the trade from the central bank unwound.

This has all caused a further drain on the reserves of the treasury.

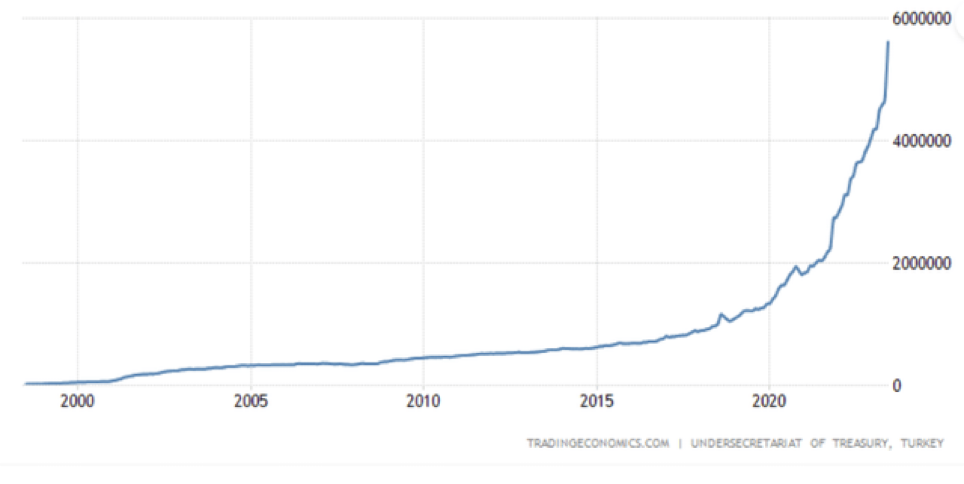

Below are the treasury’s foreign exchange reserves:

While the foreign exchange reserves don’t look like they’ve gone down significantly, it is important to keep in mind that the treasury has been issuing debt to buy foreign currency from banks in the country.

Below is the total government debt in lira terms:

Source / Trading Economics

As can be seen, the government debt has skyrocketed and the capital from debt issuance was used to support the lira. The Turkish government has even gotten to a point where its external debt in USD terms has been going up as it tries to get more fx reserves by issuing debt in USD:

Source / Trading Economics

For these reasons, even if it doesn’t look as if Turkey has an FX issue because its foreign currency reserves continue to stay elevated, it has to be kept in mind that its external debt is increasing at an unsustainable rate to support its currency.

My belief is that Erdoğan, the treasury, and the central bank all understand this issue, and hence are forced to strengthen the lira.

To strengthen the lira, the central bank would likely need to drive Turkey into a recession and raise the overnight rate above the rate of inflation.

Below is the yield curve:

Source / World Government Bonds

As the yield curve above shows everything after the 5-year is inverted. As the central bank continues to raise rates the whole curve will likely get inverted, which would be a major signal of recession.

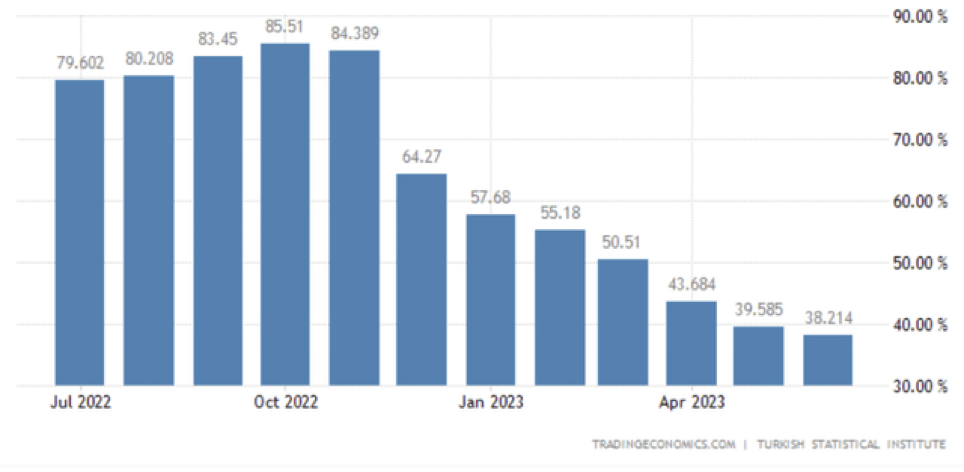

Below is the official inflation rate:

Source / Trading Economics

Keep in mind that it is well known that the inflation figures from the Turkish government are understated so ‘real’ inflation is likely higher.

Inflation has been coming down from its high but is still really high. It also looks as if, while the rate of inflation is coming down, the rate at which it is coming down has slowed, and thus it could stay sticky at around 30%-35% over the next year or so.

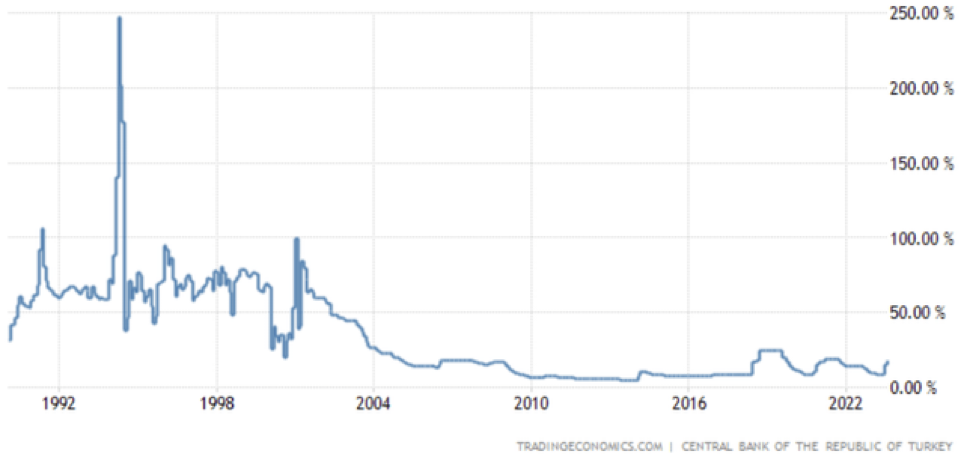

Below is the Turkish overnight rate:

Source / Trading Economics

As can be seen, the overnight rate has gone up from its lows during the current hiking cycle but is still far from where it needs to be for a stronger lira.

For currency and bonds investors to gain trust in the lira there would need to be a real rate of interest. With inflation expectations over the next year still high at 30%-35%, the overnight rate would need to go above that to get a real rate of interest. On top of that, there would need to be a risk premium to get investors interested in buying lira or lira-denominated debt, so the interest rate would really need to be even higher than 35% or so.

History has shown that rates in Turkey can go well into the triple digits as they previously have in the 1990s:

Source / Trading Economics

If interest rates go that high it certainly would solve the issue of not enough fx reserves and high inflation, but in the process shatter the economy and cause the inflation trade to unwind as I’ll discuss below.

There’s been a large inflation trade that has been put on by both speculators and defacto put on by locals in Turkey, who were forced to put it on to protect their purchasing power.

Due to high inflation in Turkey, locals would try to get rid of their lira as quickly as possible by looking to buy real assets. For many, this meant buying lots of real assets. A prime example for the average Turk was real estate, which many would buy even if the price was absurdly high and the rental yield very low.

Below is the Turkey Residential Property Price Index:

Source / Trading Economics

As can be seen, real estate prices skyrocketed, up over 6 fold.

Every day people were buying homes, often at overpriced amounts and with large amounts of debt.

This has led to a situation in the real estate market where even if buying a property is unprofitable people will still buy it. For example, if a property’s rental yield is 2% per year, but the expenses including property tax are over 2%, many would still buy the property because it’s better than losing, at its peak, 85%+ to inflation.

Similar things happened with the stock market.

Below is the BIST 100 which is the main index used to track the Istanbul Exchange:

Since the March 2020 lows, the BIST 100 is about 8 fold. The stock market was thought of as a natural inflation hedge for two main reasons. The first is that companies can raise their prices to keep up with inflation, so it offers a natural inflation hedge. The second reason was that Turkish stocks had an extremely low valuation to start with. The combination of these two made the equity market a perfect hedge against inflation.

Now that this inflation trade has played out and the government is focused on a stronger currency with high real rates, I expect this inflation trade to unwind in the other direction.

This means that a lot of companies which were clearly overvalued or zombie companies aren’t going to be propped up anymore, and real estate values are likely to mean revert a lot lower. On the flip side of the coin, Turkey is likely to go from a cash-is-trash environment to a cash-is-king environment.

There are various actionable trade ideas here.

The first one is to take the other side of this inflation trade by shorting equities. This can be done by shorting TUR. The benefit of shorting TUR is that it is priced in USD so it removes the currency risk of a weaker lira.

Another manner in which to take advantage of the current rate hiking cycle and the inverted yield curve is to short long-term government bonds and get long lira. As interest rates go higher the interest earned on the lira will go up while long-term bonds go down due to duration risk. On top of that, this trade has a positive carry due to the inverted yield curve. Also, if one is eligible, then the government’s FX-protected lira deposits would be the best way to get long lira.

The biggest long-term opportunity I see here is a crisis investing opportunity. After this inflation trade unwinds, and Turkey likely goes into a deep recession, asset prices will be very cheap which will offer the opportunity to buy high-quality and high-growth businesses at a cheap valuation.

The article above was originally published on the analysis site Seeking Alpha.

The views and opinions expressed above are the author’s and do not reflect those of the Free Turkish Press.